Local SEO Services Helping Businesses since 1998

Bring in MORE Customers – Higher ROI – Target a niche audience – Fast Results in less than 2 weeks.

Conventional SEO firms often require an extended period to deliver outcomes.

A survey of 50 businesses revealed that nearly half (47%) experienced a delay of a year or more before observing any return on investment (ROI) from SEO initiatives. Additionally, a significant 36% reported no noticeable results from their SEO efforts after a year. This equates to an average annual loss of $30,000 from marketing budgets. Furthermore, this represents a full year or four business quarters of time that businesses cannot reclaim.

Want a Free SEO Audit with Suggestions? - Let's Get Started

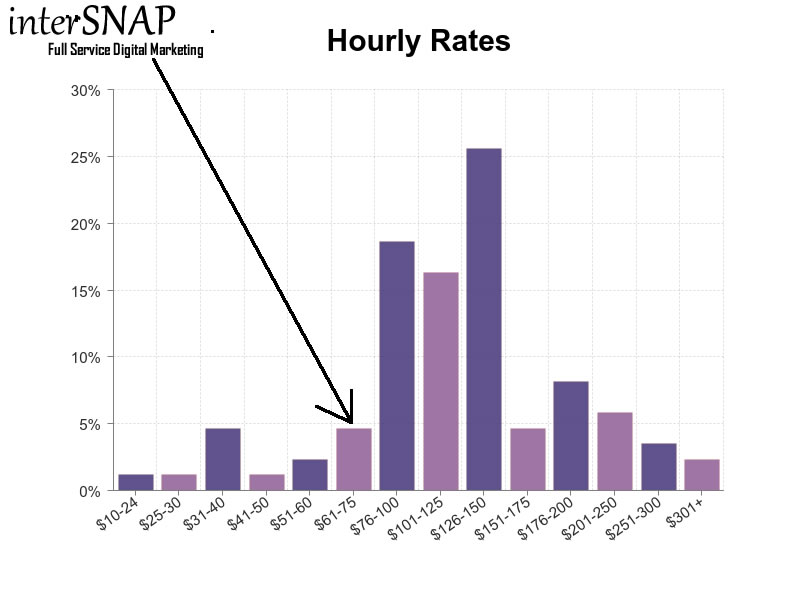

Since I’m an All-in-One Owner & Operator, you will get an incredible SEO price from me compared to the majority of SEO firms.

Ask me about my FREE SEO TRIAL for new clients!

Conventional SEO firms often require an extended period to deliver outcomes.

A survey of 50 businesses revealed that nearly half (47%) experienced a delay of a year or more before observing any return on investment (ROI) from SEO initiatives. Additionally, a significant 36% reported no noticeable results from their SEO efforts after a year. This equates to an average annual loss of $30,000 from marketing budgets. Furthermore, this represents a full year or four business quarters of time that businesses cannot reclaim.